Commitment

How we build value

We create value for investors by capturing the greenfield premium and maintaining a dedicated focus on de-risking. Our global presence and strong network of partner companies further enhance our value proposition.

We serve as an efficient link between energy projects and capital. Our industrial expertise and innovative capacity ensure speed, momentum, and agility in our energy projects worldwide. By entering projects at an early stage, we aim to secure a solid risk-adjusted return for our investors through continued diligent de-risking and leveraging our global partner network.

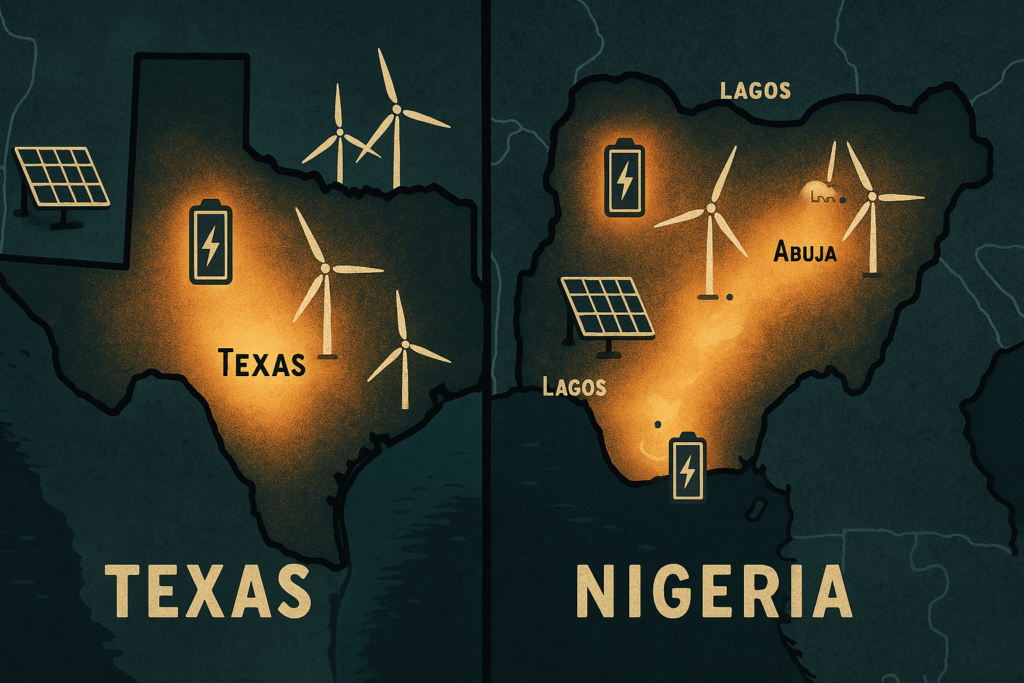

Targeting High-Demand Markets

At HQ Energies, we leverage data-driven analysis and market intelligence to identify regions with rapidly growing energy needs. From population booms to AI and data center expansions, we pinpoint underserved markets—like Texas and Nigeria—where renewable infrastructure is urgently needed. Our proactive approach ensures we deliver solutions where the demand is greatest and impact is most immediate.

De-risking Focus

De-risking investments is a key element of HQ Energies’ strategy. This is implemented at both portfolio and project levels, ensuring diversification across technologies and regions. We operate with risk limits on financial leverage, energy prices, and single investment size risk.

At the project level, we focus significantly on de-risking before making final investment decisions. We carefully select projects and industrial partners, allocating risks to those most capable of managing them. Additionally, we reduce project risk through a cautious approach to financial leverage and a focus on long-term contracting and merchant risk exposure.

Global Set-up – Local Execution

HQ Energies has built an extensive international network of industry relationships across the renewable energy sector. This includes strong partnerships in key geographies with leading utilities, developers, suppliers, and contractors.

These relationships allow us to enter attractive energy infrastructure investments early, attracting highly experienced construction management teams.

These relationships are important in enabling HQ Energies to enter attractive energy infrastructure investments early. And they have helped us to attract and select highly experienced construction management teams that have allowed us to establish a track record of developing and constructing more than 35 greenfield renewable projects with high execution certainty.

Our collaboration with Copenhagen Infrastructure Service Company (CISC) is another key component of the execution power of the HQ Energies platform. CISC is a service provider exclusively assisting HQ Energies funds in building and operating our portfolio of green energy projects. CISC has numerous offices worldwide with small teams and lean organisations with standardised, scalable and flexible set-ups. They secure a local presence and represent the primary day-to-day project organisation, interact with contractors, and have the ability to implement best practices and exercise local management during the project construction and operating phases.

On offshore wind projects we work very closely with offshore wind specialist company, Copenhagen Offshore Partners (COP). COP was established following an initiative by HQ Energies and works exclusively for HQ Energies on offshore wind development.